There's a funny thing about big companies. They hate to admit to anything. In fact, it's easier to get a five-year old to admit that he was wrong than a big company.

There's a funny thing about big companies. They hate to admit to anything. In fact, it's easier to get a five-year old to admit that he was wrong than a big company.I've written a number of blogs about the fact that the Vioxx problem could have been forseen earlier, and that much data indicated that the "magic 18 month time line" for getting a heartattack was hogwash.

Now Merck finally agrees and loses their most potent defense in their litigation.

"Merck said yesterday that it had erred when it reported in early 2005 that a crucial statistical test showed that Vioxx caused heart problems only after 18 months of continuous use.

That statistical analysis test does not support Merck's 18-month theory about Vioxx, the company acknowledged yesterday."

Read more in the NY Times.

3 comments:

Depends on how profit is calculated. Cost of goods is usually around 5-10% of selling price, rest is "profit" unless you count cost of research, marketing, selling. According to annual reports, drug industry profit is around 20% of revenue, twice the profits of oil companies.

"...20% of revenue, twice the [reported] profits of oil companies..."

We don't want to go here. Show me an oil company making as little as 20% profit and I will show you accounting fraud.

Just as a figure of merit, the profits for oil companies are somewhere in range of "the sky is the limit". Talk about creative accounting.

I once had some contacts in some of the major oil companies and every year as they laid people off and cried all the way to the bank the profit as a % of revenue just kept on rising. You can also do the "econometrics" yourself. Just keep in mind that a "barrel of oil" is sold by volume, not by weight. The weight of a barrel of oil varies widely depending on the number and type of hydrocarbons present. At refining time these hydrocarbons are released by weight, not volume. So, how many gallons of aviation gasoline are trapped in a 40 gallon barrel of crude oil? Figure that out, which is not too hard, and you will realize the enormous profit potential of oil. Better yet, if the market turns down you can leave it in the ground or store it as crude in railroad tank cars on unused sidings all over rural America. Mostly in the South for obvious reasons.

Here is how oil goes:

8:30 AM EST Monday, April 3, 2006: At last week's Citigroup private Private Equity Conference, Alan Greenspan said oil will hit $100 a barrel. The problem, said Greenspan, is that oil is not controlled by market forces but by government ones and cartels.

Greenspan said these governments and cartels are living well on the high oil prices. They don’t understand these prices are unsustainable long-term. They think people will go on forever paying these amounts and thus to keep the prices high they have not invested any serious money in oil infrastructure in the last 30 years. Only the Saudis understand that they need to keep prices reasonable to ensure that oil is the main energy source for the world forever -- and not substituted for alternative energies. The Saudis have made some key investments and are making moves to keep prices low.

I started thinking. Oil a $100 a barrel. Not driven by the burgeoning demand of India, China, etc. But by political turmoil After all, oil occurs in some of the world's most unstable countries -- Iraq, Iran, Venezuela and Nigeria. The problem is that the higher oil goes, the more money flows in, the more money the rulers steal, the worse corruption becomes, the more resentment there is, the more likelihood of more terrorism targeting the oil infrastructure, the more interruptions to oil flows, the higher the price. It's an endless cycle.

Nigeria has the eighth largest proven reserves. It exports 2.5 million barrels of oil a day. It is the fifth-largest supplier of oil to the United States; U.S. energy officials predict within ten years it and the Gulf of Guinea region will provide a quarter of America's crude. In 2002, the White House declared the oil of Africa (five other countries on the continent are also key producers) a "strategic national interest" — meaning that the United States would use military force, if necessary, to protect it. It's that serious.

Want to talk about grain, in particular wheat? Talk Cargill!

BACKGROUND ON CARGILL INC.

The Transnational Agribusiness Giant

Cargill is the worlds largest privately owned corporation according to Hoovers Corporate Reports. As such it has not needed to publicly file SEC reports in the United States on its income, profits, or executive salaries and compensation. Cargill is also the worlds largest private grain company controlling over ¼ of all US grain exports and over a quarter of the worlds grain production according to Forbes Magazine. Cargill's home page declares the company to be the third largest food processor in the world, after Phillip Morris/Kraftco/General Foods conglomerate and ConAgra foods.

CARGILL EARNINGS IN THE BILLIONS

Cargill has expanded its world wide operations to include commodity marketing, oilseed and corn processing, flour milling, meat processing, genetic seed experimentation, steel manufacturing, utility companies and financial services.

In 1990 Cargill had estimated earnings of $42 Billion US dollars. In 1995, after Ernest S. Micek was elected chairman and CEO, only the second non-family member to hold the position, the company went public with its earnings.

In fiscal 1996 Cargill sales were $56 Billion US dollars, for a total profit of $902 million up $231 million US dollars from the previous year. The company has over $21 billion US dollars in assets with offices, plants and facilities in over 1600 locations in 66 countries world wide.

As of April 1997, Cargill earnings during the third quarter of fiscal 1996-97 totaled $172 million, bringing year to date results to $658 million.

Drug and Pharma are bad because they can kill people in the name of helping them. Once you are dead it is hard to prove you might have lived if you had avoided taking the drug(s) or treatment. Oil can kill you by squeezing the economic life out of you. Cargill can kill you by monopolizing the grain market and shipping it to where it brings the most profit. Your daily bread is at direct risk!

Both are the slow death.

That's all the good news for today.

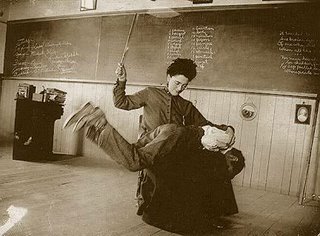

Yes, all drugs have side effects. This is a case which illustrates this to the extreme. If you are older, or have a chronic illness you take your chances, and if not, you might also die earlier. We need to know much more. Some drugs may simulate a heart attack, and it is not one; sure feels like one, though. I just had one. As for me, I liked the picture. Reminded me of my mother taking me over her knee, administering: klits, klats, klandere, van de ene bill op de andere. That is Dutch for you, "bing, bang, bother, from one side (of the butt) to the other. (very free translation). I deserved it: always talking back to her.."yes, but...". We need to know much more about drugs. I have seen and heard about many side effects of such supplements as Actonel, for example. Drug and/or supplements and even food/drug interactions need also be studied more closely. Usually the doctor knows nothing about it, and you hve to figure it out yourself, by trial and error. Hopefully no fatal error!

Post a Comment