Peter Rost, M.D., is a former Pfizer Marketing Vice President providing services as a medical device and drug expert witness and pharmaceutical marketing expert. Judge Sanders: "The court agrees with defendants' view that Dr. Rost is a very adept and seasoned expert witness." He is also the author of Emergency Surgery, The Whistleblower and Killer Drug. You can reach him on rostpeter (insert symbol) hotmail.com. Follow on https://twitter.com/peterrost

Tuesday, July 31, 2007

So is it really true . . . Rost actually working?

Peter Rost, Pfizer Scourge, Gets A Real Job

By Ed Silverman on Peter Rost

Rost Replaces Edwards at BrandweekNRX - Can it Be True?

By John Mack on BrandweekNRX

Peter Rost, Cub Reporter? A Web 2.0 Update

By pharmamanufacturing on Blogging and Web 2.0

As for my comments . . . stay tuned for tomorrow!

This blog is back to English. And Pfizer has done nothing wrong.

But I promise, it will be back to English from now on forward.

Just as an explanation; overseas traffic to my blog the last few days has been amazing, and not everyone speaks English . . . so I'm just trying to respond to the demand!

In fact, the most important visitor so far has been "Regeringskansliet"

In fact, the most important visitor so far has been "Regeringskansliet"

"Regeringskansliet" is the equivalent of the White House, in Sweden.

Sorry Pfizer, the government in Sweden, really, really, did listen to my Summer Show. I hear that you have already told the local press "Pfizer follows Swedish laws," and that you have done nothing wrong, so I wanted to make sure this was repeated right here.

For my readers from Brazil . . . Para meus leitores do Brasil!

[Este é um artigo da revista "Época" do Brasil. (Eu queria saber porque de repente eu passei a ter tantos visitantes do Brasil, mas agora eu sei. E se você precisar traduzir esta página para o português, use a ferramenta de tradução disponível à esquerda!]

ENTREVISTA

"Não confie nos laboratórios"

O ex-executivo da Pfizer diz que as práticas da indústria farmacêutica são ilegais e antiéticas

por SUZANE FRUTUOSO

Escritor sueco Peter Rost tornou-se o pesadelo da indústria farmacêutica. Ele foi demitido do cargo de vice-presidente de Marketing da Pfizer em dezembro de 2005, depois de acusar a companhia de promover de forma ilegal o uso de genotropin, um hormônio do crescimento. A substância era vendida como um potente remédio contra rugas. A empresa teria faturado US$ 50 milhões com o produto em 2002. No fim da década de 90, quando era diretor da Wyeth na Suécia, Rost denunciou também uma fraude na companhia: sonegação de impostos. Ele diz que agora se dedica a escrever o que sabe contra a indústria em seu blog e em livros. No começo do ano que vem, ele lançará Killer Drug (Remédio Assassino), história de ficção em que um laboratório desenvolve armas biológicas e contrata assassinos para atingir seus objetivos. “Mas eu diria que boa parte é baseada em fatos reais”, afirma.

Continue reading here.

Listen to my Swedish Summer Show . . .

Here's the link to the intro and here is the link to the archive to listen to show. Select "Sommar i P1 med Peter Rost måndag 30 juli 2007 13:05" and play.

And below are the two other news stories I was also involved with yesterday, in Sweden. This, including the rerun of the show above the same day, meant that Swedish Radio kindly alloted over three hours to yours truly. I'm grateful and humbled and also absolutely amazed and thankful for the hundreds of kind messages I have received from people who listened.

Thriller om läkemedelsbranschen: Vargflocken

Peter Rost, en svensk före detta läkemedelschef i USA, skrev en thriller, som han själv trodde var påhittad, om kopplingar mellan amerikanska CIA, biologiska vapen och läkemedelsindustrin. Men nyligen släppte CIA tidigare hemliga dokument, som visade att det faktiskt funnits sådana kopplingar. Hör reportage av Jenny Sanner Roosquist.

Lyssna: Reportage Thriller blev sann

Hör kommentar av Anders Nordqvist, avdelningschef FOI, Totalförsvarets forskningsinstitut, på avdelningen för skydd mot kemiska, nukleära, biologiska och radiologiska stridsmedel.

Lyssna: Samtal thriller läkemedelsbranschen

”Storbolag smiter från svensk skatt”

Internationella storföretag smiter från skatten i Sverige genom så kallade transferpriser, alltså prissättningen mellan bolagens olika dotterbolag. Det hävdar dagens sommarvärd i P1, Peter Rost, som tidigare var marknadschef på läkemedelsföretagen Pharmacia, Pfizer och Wyath i USA.

Lyssna: Nu hamnar vinsterna i lågskatteländer

Skatteverket medveten om problemen med transferpriser

På Skatteverket är man medveten om att internationella företag använder transferpriser för att flytta vinster från Sverige till länder med lägre skatter.

Lyssna: ”Vinsterna allokeras till länder med låg skattesats”

Men det är svårt att bevisa att företagen sätter felaktiga priser, säger Jan Mattsson, sektionschef på Skatteverkets utlandsavdelning. Han tror att hanteringen pågår inom många multinationella företag.

Monday, July 30, 2007

P1 Ekot om storbolagens skattefusk och P1-morgon om min nya thriller.

Thriller om läkemedelsbranschen: Vargflocken

Peter Rost, en svensk före detta läkemedelschef i USA, skrev en thriller, som han själv trodde var påhittad, om kopplingar mellan amerikanska CIA, biologiska vapen och läkemedelsindustrin. Men nyligen släppte CIA tidigare hemliga dokument, som visade att det faktiskt funnits sådana kopplingar. Hör reportage av Jenny Sanner Roosquist.

Lyssna: Reportage Thriller blev sann

Hör kommentar av Anders Nordqvist, avdelningschef FOI, Totalförsvarets forskningsinstitut, på avdelningen för skydd mot kemiska, nukleära, biologiska och radiologiska stridsmedel.

Lyssna: Samtal thriller läkemedelsbranschen

”Storbolag smiter från svensk skatt”

Internationella storföretag smiter från skatten i Sverige genom så kallade transferpriser, alltså prissättningen mellan bolagens olika dotterbolag. Det hävdar dagens sommarvärd i P1, Peter Rost, som tidigare var marknadschef på läkemedelsföretagen Pharmacia, Pfizer och Wyath i USA.

Lyssna: Nu hamnar vinsterna i lågskatteländer

Skatteverket medveten om problemen med transferpriser

På Skatteverket är man medveten om att internationella företag använder transferpriser för att flytta vinster från Sverige till länder med lägre skatter.

Lyssna: ”Vinsterna allokeras till länder med låg skattesats”

Men det är svårt att bevisa att företagen sätter felaktiga priser, säger Jan Mattsson, sektionschef på Skatteverkets utlandsavdelning. Han tror att hanteringen pågår inom många multinationella företag.

För svenska journalister . . . (for Swedish journalists).

Du kan även titta på TV och lyssna till tidigare radioinslag om mina kommentarer i både Sverige och USA här: http://sjukapengar.blogspot.com/

Om du vill nå mig, kom ihåg att jag ligger och sover i USA när P1 Ekot sänds. Du kan skriva till rostpeter@hotmail.com.

Om du vill nå mig, kom ihåg att jag ligger och sover i USA när P1 Ekot sänds. Du kan skriva till rostpeter@hotmail.com.How Multinationals Avoid Paying Taxes

Transfer pricing at heart of Pfizer case

Läkemedelsjättar smiter från skatt

Transfer pricing: Keeping it at arm’s length

Och det finns mycket mer . . . om du gör en enkel Googel sökning här.

För snabb koll av svenska läkemedelsbolag och hur stor vinst (eller ingen alls) de redovisar i Sverige, kontakta Svenska Nyhetsbrev, och köp statistikboken "Läkemedelsbolagen i Sverige 2006" som de ger ut.

För snabb koll av svenska läkemedelsbolag och hur stor vinst (eller ingen alls) de redovisar i Sverige, kontakta Svenska Nyhetsbrev, och köp statistikboken "Läkemedelsbolagen i Sverige 2006" som de ger ut.Den är mycket dyr men värd varje krona.

Du kommer att upptäcka precis hur "olönsamt" det är att sälja läkemedel i Sverige . . . och hur lätt det är för företag att skatta noll i det svenska jämlikhetsparadiset.

Fast det är inte så lätt för Kalle Snickare och Nisse Bagare förstås.

För de har inga filialer utomlands.

Sunday, July 29, 2007

OK, I admit. I'm having a Sunday evening Swedish ABBA party.

And just getting my U.S. readers up to date on an important part of Swedish music history . . . nothing like a Swedish music video from the 70s . . .

Celebrating summer in Sweden . . .

I really don't want any Pfizer lawyers to miss any of this, especially since they'll spend a fortune on translations, so here's the deal:

I really don't want any Pfizer lawyers to miss any of this, especially since they'll spend a fortune on translations, so here's the deal:Tomorrow, Monday July 30 is finally the day when I get to do an hour and a half on Swedish Radio. Twice in the same day, so a full three hours in one single day.

Pfizer lawyers, please go here to download and listen to music and talk.

And if that show is too long for you, we also did a separate recording for P1 Morgon, as well on the financial news, P1 Ekot.

Should you not like any of this, you can also use the radio archive of the Swedish Summer Show to listen to actress Lena Olin. Or perhaps author, singer and centerfold Magdalena Graaf . . . or maybe industrial tycoon, Michael Treschow.

Should you not like any of this, you can also use the radio archive of the Swedish Summer Show to listen to actress Lena Olin. Or perhaps author, singer and centerfold Magdalena Graaf . . . or maybe industrial tycoon, Michael Treschow.And to really get into the right mood, here's some real Swedish music. From 1965.

Cheers, Pfizer and Epstein, Becker & Green. Without your investigators, detectives and highly paid lawyers monitoring me, this wouldn't be half as much fun!

Friday, July 27, 2007

I'M GOING TO BE A JOURNALIST!!!

No, I'm not kidding.

No, I'm not kidding.I'm going to get paid for writing, with a monthly salary check.

My stories will appear on the web, initially. But it is a real magazine; you know, printed paper and hundreds of thousands of subscribers. Or something in that range.

So, hey. Now I REALLY need your stories.

Stay tuned.

I'll tell you more next week.

And don't worry.

The things that aren't printable, I'll still print right here, on Question Authority.

So don't go away!

MedAdNews "Pharma Blogs: Week in Review"

Click here to subscribe to Pharma Blogs: Week in Review or our other eNewsletter.

Pharmafraud's blog review . . .

Go here to read.

Here's what s/he has to say about Question Authority:

Question Authority with Peter Rost - I've got to give Dr. Rost credit for showing us how much power one individual, with an opinion, some facts, and a Blog, can have. This is the first Blog I look at every day. Rost has exposed a lot of the Pharma Industry's dirty dealings. He's shamed Pharma companies into addressing some of their dirty deeds, and every Pharma company has probably altered their communication policies in consideration of the consequences that may occur if Dr. Rost gets ahold of one of their emails.

When Dr. Rost isn't being fed internal documents from a wronged Big Pharma employee, his blog doesn't pack the punch that it could. Even Dr. Rost falls into the same trap as other Bloggers when they have no story; just copy and paste some crap from another blog.

In his Big Pharma days Dr. Rost was a marketing guy, so he should know the value of a clear and powerful brand name. Why is the Blog named, "Question Authority with Dr. Peter Rost"? Drop the "Question authority", it's a bit weak. Peter Rost is the brand. Why water down the most powerful Brand in all of Blogdom. Use Question Authority as a tag line if you must, but don't muddle up brand.

Dr. Rost's biggest sin? - By offering Dr. Rost the scoop when my story breaks, I met my obligation of kissing his butt, and yet he ignores my blog. Nevertheless I'll keep my word and give him the biggest scoop of his life when my gag is removed.

Do YOU agree with Pharmafraud?

99,000 Dead.

One of every 22 patients will get an infection while hospitalized — 1.7 million cases a year — and 99,000 will die, often from what began as a routine procedure. Every year.

Story in New York Times.

Thursday, July 26, 2007

Are lawyers about to take over Big Pharma?

Now Merck promoted its general counsel, Kenneth C. Frazier, to the second position of the company. He will be executive vice president and president, Global Human Health.

I think Big Pharma sees Big Problems on the horizon.

And since lots of litigation with billions of dollars are at stake, the general counsel is the guy who get to show his stuff.

Why do they put nails in coffins?

To stop oncologists from giving chemotherapy!

To stop oncologists from giving chemotherapy!This is a guest article from an anonymous pharmaceutical drug rep:

If you have cancer, a big factor in your chemo decision is profit. Medical Oncologists are the cancer doctors that give chemotherapy.

Most of them are in group practices that buy intravenous drugs from specialty wholesalers.

When it's time for your treatment, a nurse will 'hang a bag' on the IV pole near your treatment chair and start dripping chemo into your veins.

The office then bills insurance (80%) and collects your co-pay (20%). Medical oncologists make money by 'keeping the chairs filled'.

Recent changes to Medicare limit drug profits to about 6%. If physicians buy $1,000 worth of drug they are reimbursed $1,060.

This is enough to cover costs and make a modest profit. Every quarter, Medicare reimbursement rates for chemotherapy change. Office managers compare these rates with acquisition costs and recommend agents to avoid or take advantage of.

There are a two other problems with this system:

- If a physician's yield is constant they are inclined to use more expensive drugs, even if they have the same therapeutic effect. For example, the $6,000 profit of a $100,000 drug is much higher than the $60 profit from a $1,000 drug. Insurance companies and patients pay the difference.

- In order to make money, physicians must collect co-payments. Conversely, they lose money if they don't collect co-payments. Let's say a patient doesn't cough up his $212 co-pay for a $1,000 drug. Even if a physician gets $848 from Medicare, he just lost $152 in the transaction.

Do you think he's going to use an even more expensive drug? Even one that could be more effective? Not unless they collect that co-payment up front.

- Bottom line? If your medical oncologist is confident that you can make your co-payments, you'll get the most expensive drugs on the market whether you need them or not.

There's an old joke: Why do they put nails in coffins? They do it to stop medical oncologists from giving chemotherapy. I guess now it depends on whether or not the dead can afford their co-payments.

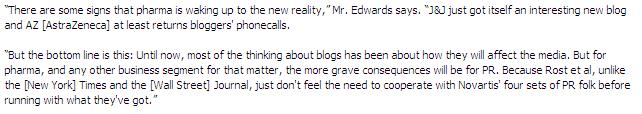

WSJ: Pfizer caught pants down - TRANSFER PRICING FRAUD

Here is an amazing article from today's Wall Street Journal/LiveMint.com about how Pfizer cheated share holders and the Pakistani government, using inflated transfer prices to make the local unit appear unprofitable. Of course, if you have read my article How Multinationals Avoid Paying Taxes, you already know who this works . . .

Transfer pricing at heart of Pfizer case

Shareholder allege that Pfizer has deliberately contributed to poor results at its Pakistani operations, thus diluting the value of the minority stakeholders' shares

Leela Ann Parker

Wall Street Journal/LiveMint.com

Posted: Thu, Jul 26 2007.

Drug giant Pfizer Inc. says it will appeal a court ruling in Pakistan that has called its behaviour “oppressive” and sided with a small group of investors who had alleged that the multinational systematically drained the coffers of its local operations through artificially high prices for drug ingredients.

See: The 21 May court ruling

The eight investors—two others died waiting for the verdict—are part of a dwindling group of shareholders who now own less than 0.5% in Pfizer Laboratories Ltd (PLL), which is the current version of Pfizer’s operations in Pakistan that has origins in a manufacturing facility opened in 1961. Some of the shareholders who have been fighting Pfizer in court maintain that their original holdings are investments that their parents made in a company called Dumex, acquired by Pfizer in 1959.

At its core, the legal battle is fairly simple. The shareholders allege that Pfizer has deliberately contributed to poor results at its Pakistan operations, thus continuously diluting the value of the minority stakeholders’ shares in an attempt to get 100% control of the business for a lot less than what it is worth.

Interwoven into this saga is a larger issue of “transfer pricing,” a common system under which related but separate companies assign prices for goods or services transferred from one company to the other. Because these are negotiated prices, there can be a potential for one company, especially the parent or majority shareholder, to take advantage of a unit.

Governments and regulators in the developing world, including India and Pakistan, have been particularly wary of opaque transfer pricing mechanisms as they fear that a foreign parent company could use such transactions to drain resources away from the local unit to a foreign parent. That is precisely what happened with PLL, say these minority shareholders who allege that Pfizer sold raw materials at huge markups. They say because Pfizer took equity in return for the cash it pumped into the struggling operation, the drug giant ended up with a growing share of PLL at the cost of minority investors whose equity only fell over time.

According to a court ordered examination of PLL’s practices done by Ernst & Young, Pfizer exported drug raw materials to the Pakistani unit at prices that were, in some cases, up to 70 times those charged by alternative providers. For example, the court papers show, amlodepine besylate, the active ingredient in high-blood pressure medicine Norvasc, was sold at $30,000 per kg while alternative sources could have provided it for as little as $500 per kg. Another example was of piroxicam, used in arthritis drug Feldene, which was allegedly imported by PLL at $8,750 per kg, compared with $125 per kg in the market. Another ingredient, doxycycline, found in antibiotic Vibramycin, was imported by PLL at $700 per kg though it could have been purchased for $60 per kg.

Hat tip Pharmalot.

Pfizer India Scandal spills into Pakistan: Court says "valuation was not fair"

Link to article here.

Wednesday, July 25, 2007

Tuesday, July 24, 2007

Today's Quote: "Rost has broken more scoops on the drug biz this year . . . than the WSJ, the NYT, BusinessWeek, Forbes, Fortune or any of those guys"

"Last week, Peter Rost broke a nice scoop about how Novartis has allegedly submitted false data to the FDA to support its application for Tasigna. That application -- by amazing coincidence! -- has now been delayed while Novartis provides more information from the FDA."

"Lesson one, the scoop was broken on a blog, Peter Rost's, and not by the WSJ, the NYT, BusinessWeek, Forbes, Fortune or any of those guys."

"Arguably, Rost has broken more scoops on the drug biz this year (AZ bucket of Money scandal, Pfizer Maraviroc scandal, Pfizer India scandal, and now this one) than any single reporter at any of those publications."

Novartis bites the dust.

Have your people been on a national Swiss holiday or something?

I mean, it's been pretty normal visiting stats for a few day, but today you are all coming here . . . I usually have a pretty good stream of visitors, but today you guys are just storming my blog . . . shouldn't a few of you be working, or something, and not reading blogs?

Oh, you just discovered blogs, did you?

Oh, you just discovered blogs, did you?Funny thing, those bloggers.

They're all over the place.

Like sharks, smelling blood in the water.

And you shut one down ten more pop up.

It's not like newspapers. They shut themselves down. Or get sold to Rupert Murdoch.

But bloggers don't sell out. No big ad money, no pressure, no leverage for people like you.

This song is for you, Novartis. The Novartis Whistleblower story rocks on:

HERE IS VIVA VIAGRA AD!

So Question Authority is first in the blog world to introduce Pfizer's new ad that got AIDS activists steaming - Viva Viagra.

Michael Weinstein, president of the AIDS Healthcare Foundation was quoted by Bloomberg News saying, "Pfizer has been an outlier in shamelessly promoting Viagra as a party drug. All those Sin City references, everything associated with Vegas, that is what they want the association to be. It's not about a medical condition, it's about performance anxiety."

And Brandweek penned the headline, Viagra Campaign Suggests Pfizer No Longer Interested in Medicine.

As far as I'm concerned . . . c'mon everyone. Let's get real. It's just sex. Don't have a heart attack about the fact that Pfizer is trying to make a few bucks from men trying to get a hard on. After all, everyone else is too . . . trying to make a few bucks from those same men, I mean.

By the way, here's the original, Viva Las Vegas with Elvis Presley:

Hat tip Pharmagossip for that last clip. And he has more! Go there.

Pfizer Whistleblower Blog Turns Up the Heat

A new story posted today gives new details about Pfizer's maraviroc scandal.

A new story posted today gives new details about Pfizer's maraviroc scandal.It must be getting hot over at Big Blue.

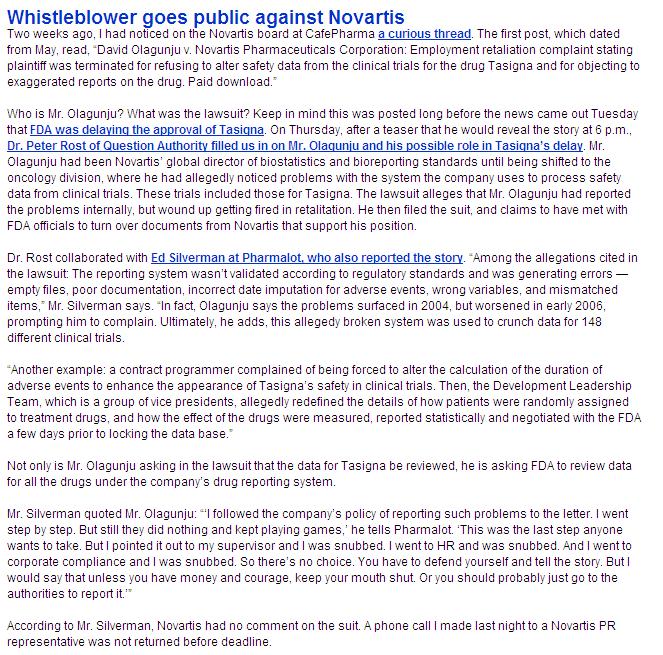

Does Novartis Hate Whistleblowers?

I didn't realize that I should probably write this article, until I got involved in the more recent Novartis Whistleblower story with David Olagunju, who was fired after he objected to Novartis messing around with clinical data - at least that is what he claims in his lawsuit.

So here's what happened to me, which made me wonder, a few years back: Does Novartis hate whistleblowers?

I had decided to look for work in another drug company. So I wrote an e-mail to Dr. Daniel Vasella, CEO of Novartis. He was apparently impressed, because he responded right away and set up a meeting for me with Thomas Ebeling, his right-hand man, who had joined Novartis from PepsiCo, and was CEO of Novartis' pharmaceutical business.

We met at Short Hills Hilton in NJ, and the interview went well. I also told him about my internal whistleblowing and what had concerned me, and he laughed at that part. We got along well and I really enjoyed the meeting.

So I was whisked over to Basel, Switzerland, and met with Dr. Vasella himself, and Novartis senior management, since I was interviewing for the German country manager job, one of Novartis' largest markets.

So I was whisked over to Basel, Switzerland, and met with Dr. Vasella himself, and Novartis senior management, since I was interviewing for the German country manager job, one of Novartis' largest markets.I also met Novartis' Head of Global HR.

And that's when something happened. I told him why I wanted to switch jobs and mentioned some of the ethical issues I'd brought up with Ebeling. The temperature in the room immediately went from sunshine to Arctic cold. Let's say he didn't have a poker face.

Even before I left the Novartis office in Basel, Ebeling told me that he had kind of laughed at those issues I had brought up, but others hadn't, and there would be no job offer.

Of course, this really made me wonder what those Swiss were up to . . . and what Novartis was hiding.

And I wouldn't have thought more about this, unless, quite some time later, I was invited to interview with Novartis again.

And I wouldn't have thought more about this, unless, quite some time later, I was invited to interview with Novartis again.This time I went to London and met with two business people from Novartis, (see business cards to the left).

And they were impressed and recommended that I should go to Basel to meet key people.

I didn't want to waste my time, so I contacted Ebeling, and told him what was up, so that he could stop the whole thing if Novartis still had a problem with me.

But things went forward, and an agenda for the meeting was sent to me.

I was excited, ready to leave, and then, the day before I was going to take off, I got a call from one of the people who'd interviewed me.

He said that they'd found an internal candidate for the job, and I should cancel the trip. That was really last minute, and really weird, so I contacted the recruiter who'd set the whole thing up.

Unfortunately for Novartis, they had told her an entirely different story.

According to the recruiter, the head of Novartis HR had rushed in to the people doing the hiring and told them to immediately cancel my interview, without any explanation.

According to the recruiter, the head of Novartis HR had rushed in to the people doing the hiring and told them to immediately cancel my interview, without any explanation.The recruiter was wondering what I could possibly have done to cause this reaction . . . since Novartis obviously wanted to make sure that no one at the company interviewed me.

I agreed that something very strange was going on.

I had gone from being a top candidate, with a performance good enough to get me interviewed personally by Dr. Vasella, to being a person they wanted to make sure no one made the mistake of hiring.

What is even more interesting, is that some time later, Novartis sent out a letter to all employees. It deals with whistleblowers.

Click on images below to read . . .

Quite an irony, I'd say.

And here is the Novartis Whistleblower manual . . . click on images to read:

How the drug makers thumbed their nose at the American people. Again.

Today the New York Times does the same:

July 24, 2007

Tax Break Used by Drug Makers Failed to Add Jobs

By ALEX BERENSON

Two years ago, when companies received a big tax break to bring home their offshore profits, the president and Congress justified it as a one-time tax amnesty that would create American jobs.

Drug makers were the biggest beneficiaries of the amnesty program, repatriating about $100 billion in foreign profits and paying only minimal taxes. But the companies did not create many jobs in return. Instead, since 2005 the American drug industry has laid off tens of thousands of workers in this country.

Drug makers were the biggest beneficiaries of the amnesty program, repatriating about $100 billion in foreign profits and paying only minimal taxes. But the companies did not create many jobs in return. Instead, since 2005 the American drug industry has laid off tens of thousands of workers in this country.And now drug companies are once again using complex strategies, many of them demonstrably legal, to shelter billions of dollars in profits in international tax havens, according to their financial statements and independent tax experts.

In one popular accounting move, companies declare their foreign markets as far more profitable than their American businesses — even though drug prices are typically higher in the United States than anywhere else in the world.

Drug makers are not the only American multinationals using tax loopholes to declare large portions of their income beyond the reach of the Internal Revenue Service. The Brookings Institution estimates that multinational companies are using overseas tax shelters to lower their payments to the Treasury by about $50 billion a year.

But the drug industry accounts for one of the biggest portions of that shortfall, according to the I.R.S. and independent tax experts. And the nature of their business gives drug makers techniques, like sheltering valuable pharmaceutical patents in tax-friendly havens like Ireland, that many other industries cannot use.

Moreover, the sheer heft of the American drug industry, which had about $60 billion in pretax profits last year, can give disproportionate weight to the economic impact of its tax sheltering techniques.

Even though the tax amnesty legislation has expired, its passage encouraged companies to be even more aggressive about sheltering money, expecting another holiday in the future, said H. David Rosenbloom, director of the international tax program at New York University. Democrats and Republicans supported the legislation, which passed with sizable majorities in October 2004.

“Congress can swear on two stacks of Bibles that it’ll never do it again,” Mr. Rosenbloom said, “but they’ve lost their virginity.”

With a few narrow exceptions, the drug companies are supposed to be paying as much as 35 percent of their worldwide profits in United States federal taxes. In reality they pay much less.

Last year, for example Eli Lilly, the sixth-largest American drug maker, paid less than 6 percent of its profits of $3.4 billion to the United States government, according to its financial statement.

Amgen, the American biotechnology giant, which reported last year that 80 percent of its $14.3 billion in sales occurred in this country, paid about 22 percent in United States federal tax on its $4 billion in profits.

The discrepancy was possible because Amgen claimed a profit margin of almost 100 percent on its foreign sales, but only 15 percent on its American sales.

The I.R.S. has recently increased the number of examiners trying to find hidden profits overseas. It has even had some victories, as in February when the drug maker Merck agreed to pay $2.3 billion to the government to settle a claim it had hidden profits in a Bermuda partnership.

“This is really a priority for the service right now — there’s a lot of focus on cross-border transactions,” said Frank Y. Ng, the I.R.S. deputy commissioner for international tax matters. But even after adding resources, the I.R.S. has only about 500 examiners to review international returns.

Lilly said in a statement that it complied with the law in taking advantage of the 2005 tax amnesty, which enabled the company to avoid more than $2.3 billion in American taxes. Lilly said it believed that the 2005 tax break had encouraged investment in the United States, noting that the company, which is based in Indianapolis, has invested $1.3 billion in the state of Indiana alone.

Still, since the beginning of 2005, Lilly has cut its United States work force by more than 8 percent, reducing it to 22,000 jobs by last January.

Lilly also noted that its overall reported worldwide tax rate for 2006 — which includes taxes paid to other countries and taxes that it has deferred but will theoretically pay at some future date — was about 20 percent in 2006.

Pfizer, Merck and Amgen declined requests for comment.

Tax experts like Michael J. McIntyre, a law professor at Wayne State University in Detroit, say the drug makers are taking advantage of antiquated rules that work better for manufactured products like steel and automobiles.

Under this system, when companies transfer products between divisions in different countries, they must account for the sales internally through “transfer pricing.” But they have significant discretion in how they set prices for these transactions.

That turns out to be especially so for high-margin products like drugs, which in pill form cost only a few cents each to make once they have been invented, but can be sold for several dollars apiece. The hefty profit margins result in part from patents that can protect the drugs from competition for years. And by transferring those valuable patents overseas, companies can declare that their profits should follow the patents overseas as well.

Under the rules of transfer pricing, if a company moves patents or other so-called intangibles from its United States division to a foreign subsidiary, the foreign unit is supposed to pay the American division a fair-market price. But outsiders have a difficult time determining if companies have properly assessed the value of patents, trademarks and other intangible properties.

To further complicate matters, some corporate subsidiaries in tax-haven countries, like Singapore and the Netherlands, now directly finance research in the United States. So they own the patents without ever having to “buy” them from their American parents, Mr. McIntyre said.

“They don’t even have to push it offshore,” Mr. McIntyre said. “It’s already offshore. And once it’s offshore, they strip the income from the onshore activity.”

In theory, companies are only deferring taxes on the profits they shelter overseas, not permanently avoiding tax. If they bring the money back to the United States to distribute to their shareholders, they still have to pay American taxes on it.

But those rules were temporarily suspended when President Bush signed legislation in 2004 to let companies return overseas profits at a rate of 5.25 percent, far below the official tax rate of 35 percent, if they moved the money back by 2006.

During that period, multinational companies of all stripes moved a total of about $300 billion into the United States, avoiding about $90 billion in taxes. Among them, the pharmaceutical industry was the largest single beneficiary. Leading the pack was Pfizer, the world’s largest drug company, which repatriated $36 billion.

The quid pro quo was supposed to be that the drug industry would invest some of its tax windfall in American operations and jobs. Instead, struggling with a dearth of new blockbuster drugs, they have had mass layoffs. Again, Pfizer has been the leader, reducing its work force by about 8,000 in 2006 and saying early this year that it would lay off an additional 10,000 employees.

Some experts now say the current system of taxing overseas profits should be scrapped. Even the companies that take advantage of loopholes might benefit if the system were changed, because they could save money on tax planning and have more certainty that the I.R.S. would accept their returns, said Michael C. Durst, a former I.R.S. official who is now special counsel to the law firm Steptoe & Johnson.

The simplest solution, Mr. Durst said, would be shifting to a system in which companies would assign a portion of profit to each country where they made a sale, relative to the size of the sale. Instead of trying to tax profits made overseas, the United States government would simply take its share of the profits on American sales. Such a system would be harder for the companies to game, Mr. Durst said.

But he and other tax experts say that any effort to close loopholes, to be politically viable, might have to be combined with a lowering of the corporate tax rate from its current 35 percent. And no one expects any legislation of that sort, at least not before the next election.

Monday, July 23, 2007

Pfizer Whistleblower Blog

Pfizer HR document detailing allegations of corruption in the HIV Division.

A letter of resignation.

A distict manager fired.

A gag order.

A directive to delete email.

Acts of retaliation.

17 Ways for Docs to Get Rid of Pharmaceutical Reps

1. Develop a chemical sensitivity to pizza and doughnuts

2. Ask them if they give the product to their kid.

3. Establish a strict office dress code. Tell your office manager not to admit anyone wearing tailored skirt suits or highly polished shoes. ( As an added bonus this will limit the number of lawyers who seek your services.)

4. If they are hawking antidepressants, tell them you only treat children, and ask them to send you full color brochures about their “black box.”

5. Be sure to return all of your phone calls while the rep is waiting to see you.

6. Hire a pharmacology graduate student to help out in your front office. The drug rep may not see you, until the student has finished quizzing him on the chemical properties of all of his products.

7. Schedule four of them at the same time and only see the one who emerges from your waiting room alive.

8. Ask them whether their company has underwritten psychologists' efforts to get prescribing privileges.

9. If the drug rep is hawking stimulants, send them back to your office and confidentially tell him that you have had a bit of a problem with your DEA license. Could they provide you with lots of free samples?

10. Post the AMA ethics guidelines about dealing with pharmaceutical companies in your waiting room and ask your office manager to review the guidelines monthly.

11. Get your information about psychopharmacology from talking to colleagues, attending seminars, and reading journals.

12. Post signs that exclude any rolling bags whatsoever!

13. Schedule appointments no earlier then 5 pm, preferably on Fridays.

14. Never let the sales rep see your doctor if he/she shows up with the manager even if they have appointment.

15. Book appointments well in advance, by scheduling all the reps from one company on the same day (you may have 5-8 of them) and same time late in the day. When they all come in you leave on "emergency" call. Repeat for all companies

16. Do the same with lunches but with 5-10 different companies. When they show up with food, call as many homless persons as you can to the feast.

17. .......you continue

Hat tip CP.

Pharmalot: "Novartis Whisteblower: The Departing E-mail"

Pharmalot has continued to dig deeper, go here to read:

Novartis Whisteblower: The Departing E-mail

Tomorrow: Does Novartis hate whistleblowers?

Internal Novartis documents.

Right here in 24 hours.

Brandweek: "Novartis and Olagunju: A Case Study in Pharma PR and Media Failure"

July 23, 2007

Novartis and Olagunju: A Case Study in Pharma PR and Media Failure

Last week, Peter Rost broke a nice scoop about how Novartis has alledgedly submitted false data to the FDA to support its application for Tasigna. That application -- by amazing coincidence! -- has now been delayed while Novartis provides more information from the FDA.

Last week, Peter Rost broke a nice scoop about how Novartis has alledgedly submitted false data to the FDA to support its application for Tasigna. That application -- by amazing coincidence! -- has now been delayed while Novartis provides more information from the FDA.

This comments thread on Ed Silverman's Pharmalot contains pretty much everything you need to know about blogs, pr, the media, pharma marketing and the future.

Lesson one, the scoop was broken on a blog, Peter Rost's, and not by the WSJ, the NYT, BusinessWeek, Forbes, Fortune or any of those guys. Arguably, Rost has broken more scoops on the drug biz this year (AZ bucket of Money scandal, Pfizer Maraviroc scandal, Pfizer India scandal, and now this one) than any single reporter at any of those publications. It used to be that the media's fear of blogs was offset by blogs' dependency on the media -- blogs were reduced to fact-checking or commenting on real reporting that was still done by the media. But now that is no longer true. Any of these stories would have made decent 'readers' at the WSJ, but instead that paper's coverage of them has been tepid at best and non-existent at worst.

Lesson two, Novartis -- and I can say this from experience, virtually every pharma company operating in the U.S. -- is not equipped to deal with the blog-based internet media. Look at this description, by Ed Silverman, of Novartis' pr resources:

"Novartis is a complicated beast - pr is run out of Basel, then

there’s the New York corporate office and finally, there’s the pharma

appartus in East Hanover, NJ. This makes it difficult for me to know

where to turn, partly because Basel sometimes, I believe, viewed The

Star-Ledger as local media. Pharmalot, however, is seen all over the

place (and I noticed a great number of Basel readers over the past two

days). So maybe now I’m on their radar."

None of the execs answering the phones in any of those three offices -- four if you count their outside pr counsel, Ruder Finn -- has the power to simply return a phone call and engage in a straight conversation with a reporter. They all have to consult with each other before delivering a canned answer itself creates more questions than answers.

Lesson three, in the old days, the news media didn't pay much attention to who delivered the message to them. If the comment came from a company spokesperson or the company's outside pr agency, it didn't make much difference to us. But for bloggers like Rost, the medium is the message and your pr people -- and lawyers, for that matter -- are now as much a part of the story as the story itself is. Check out Rost's blast of Ruder Finn here. This is not the first time Ruder Finn has managed to become the subject of coverage rather than a guider of coverage. See here, here, here and here.

It's not limited to Ruder Finn, of course. Robinson, Lerer & Montgomery managed to get themselves mentioned here and here.

There are some signs that pharma is waking up to the new reality. J&J just got itself an interesting new blog and AZ at least returns bloggers' phonecalls.

But the bottom line is this: Until now, most of the thinking about blogs has been about how they will affect the media. But for pharma, and any other business segment for that matter, the more grave consequences will be for pr. Because Rost et al, unlike the Times and the Journal, just don't feel the need to cooperate with Novartis' four sets of pr folk before running with what they've got. And Rost's sources (and Ed's and Jack's and this guy and this guy and this guy) don't feel the need to wait for The Times and the WSJ to conclude that their info has reached whatever importance threshold they use as a benchmark before publishing -- and beating them -- on some great stories.

Whistleblower Hell

Listen to the latest MP3 hit from Homeless Joe & The Pharma Spies here.

"This song is dedicated to Novartis whistleblower Mr. David Olagunu."

Lyrics to "Whistleblower Hell" MP3 Song Parody:

I knew it was illegal,

that they were clearly wrong.

I was feeling kind of worried,

but my conscience made me strong.

The company got nasty,

when I told them what I'd found.

then they called out all their thugs and goons,

and beat me to the ground.

And so I woke up in the gutter,

for being honest with myself,

because the company just sent me,

into whistleblower hell.

They said that it was treason,

As they showed me the door

now I'm sleeping near a dumpster,

cause the beatings left me poor.

My wife and children ditched me,

and I'll never work at all.

My murder will come it's plain to see,

but I'd do it all again.

And so I woke up in the gutter,

for being honest with myself,

because the company has sent me,

into whistleblower hell.

Saturday, July 21, 2007

Tuesday next week: "Does Novartis hate whistleblowers?"

On Tuesday.

Only on Question Authority.

With internal Novartis documents.

Whistleblowing for Dummies?

Novartis (non)-response to Question Authority causes debate

It is important to point out that while both Ed Silverman and I sought out David Schwab, formerly of the Star Ledger, since we know him, he is not the one who responds to journalists and no stones should be cast in his direction.

Clearly someone else at Novartis decides who deserves a response and who should be snubbed.

Perhaps also PR firm Ruder Finn has a finger in this decision; they've been going crazy reading this Novartis Whistleblower story.

As far as I'm concerned, in a way I take Novartis' non-response as a compliment. The drug industry clearly is trying to pretend like I don't exist.

Below is the exchange between John Mack and Ed Silverman, on Pharmalot:

-------------------------------------------------------------------------------

John Mack

Peter Rost mentioned “his old friend”, David Schwab, “from the Star-Ledger who is now over at the PR department at Novartis” in connection with this response from Novartis. Could this be the person who wrote this “crap” and responded to you and NOT to Peter?

Is there some conflict of interest story here involving Pharmalot, Newark Start Ledger, and Novartis?

Just thought I’d ask .

John

-------------------------------------------------------------------------------

Ed Silverman

John,

No, let’s the clear the air immediately.

First, the comment came from Sheldon Jones, a former Ciba-Geigy pr person who now works in the Novartis corporate office in New York in communications.

David Schwab, with whom I worked at The Star-Ledger for many years, including several that involved sharing the pharma beat, left the paper last year to join Novartis as an internal communications person. He often fields reporter requests and then, if possible, redirects them to the appropriate pr person. I’ve never quoted him. As far as I know, he’s not assigned to ‘external communications.’

I reached out to him on Thursday afternoon to find the ‘right person’ at Novartis for a response. Late in the day, I received a call from a woman who does pr consulting for the company. I told her what I wanted and she called later to say there was no comment.

Now, about the belated Novartis statement. I knew nothing about it until I received an e-mail late yesterday from Jeff May, who works at The Star-Ledger as a business reporter covering pharma. He wanted to make sure that I was aware of the Novartis statement he received. He received it because he was following up my original Thursday post about the Olagunju lawsuit. I’d not seen it.

Why? Sheldon Jones unfortunately assumed that by sending it to May, I would also see it, that the bases were covered. They weren’t. I wrote Sheldon to complain about that and point out that pr people have to reach out to me/Pharmalot separately and, in this case, he was remiss not to have automatically sent me the statement. He wrote back with a ‘mea culpa’ reply.

Both Peter and I were free, of course, to follow up yesterday and again seek comment. I didn’t do so. I had received, less than 24 hours earlier, a no comment. I assumed that, if Novartis had something to say, they knew how to reach me.

But Novartis is a complicated beast - pr is run out of Basel, then there’s the New York corporate office and finally, there’s the pharma appartus in East Hanover, NJ. This makes it difficult for me to know where to turn, partly because Basel sometimes, I believe, viewed The Star-Ledger as local media. Pharmalot, however, is seen all over the place (and I noticed a great number of Basel readers over the past two days). So maybe now I’m on their radar.

In any event, I don’t know if Peter reached out to David or anyone else at Novartis yesterday to follow up. Did you ask him that? Did you call anyone at Novartis for their take on this? You have my rundown, and I stand by it.

And in the interest of further full disclosure, I’ve known David for many years, as I mentioned, and we sometimes socialized. Also, David, at my urging, wrote a profile of Peter a few years ago when Peter began making waves about reimportation and his story was the first - along with a similar profile the same morning in The Boston Globe. And I sometimes have met with Peter for coffee to discuss his Pfizer litigation, which I’ve sometimes written about; industry topics and, of all things, blogging. However, those have been what I would call working meetings; we don’t socialize. More full disclosure, I live two minutes away from both of them (along with a gazillion other pharma people).

So who will cast the next stone?

ed

Friday, July 20, 2007

Novartis snubbed me so here is my response . . .

So stay tuned for Monday . . . there will be a new hit song officially dedicated to the Novartis Whistleblower revealed on this blog.

Come back Monday!

"These allegations can impact Novartis's bottom line in a major way"

While I can't really determine whether Novartis is "at fault" from these two stories (and related echos throughout the pharma blogs), I can tell you about statistical reporting systems, and why I think that these allegations can impact Novartis's bottom line in a major way."

Read just how this biostatistician thinks the Novartis Whistleblower allegations can impact Novartis' bottom line. Go to Realizations in Biostatistics.

MedAdNews "Pharma Blogs: Week in Review"

Click here to subscribe to Pharma Blogs: Week in Review or our other eNewsletter.

"I’ve always admired Novartis as one of the truly ethical pharma companies, so these allegations are extremely disturbing."

Read what more Pharma has to say about the Novartis Whistleblower story, in Novartis’ Whistleblower Alleges Problems With Clinical Trial Safety Reporting.

"Big Pharma's Nigerian Nightmare"

Here's how the post starts:

What was the deal yesterday with the drug business and things of Nigerian origin? Two stories yesterday both involved Nigerians with angry lawers accusing companies -- Novartis and Pfizer -- of misdeeds.

First, Peter Rost broke a nice scoop on a former senior data analyst at Novartis who claims the company submitted flawed data to the FDA: Nigerian-native David Olagunju alleges in a suit that he was fired for "disclosing and refusing to participate in illegal and unethical activities regarding the testing and reporting of human drug study results concerning Tasigna (ANM), Novartis' new cancer drug."

Guess what? Novartis recently announced that its Tasigna approval application was being delayed by the FDA. (Ed Silverman at Pharmalot carries a different take here.)

Interview with Novartis Whistleblower's attorney

Today I had an opportunity to speak to David Olagunu's attorney, William J. Courtney, Esq., who has practiced employment law in NJ for over twenty years.

Courtney told me this was a "classic example" of how companies go through the motions when they try to fire a whistleblower. He said that soon after Olagunju started bringing his concerns to Novartis' management, his performance rating went down and he was eventually put on a performance improvement plan and then terminated.

Olagunju is a twenty-year industry veteran with no history of whistleblowing or problems with anyone through his distinguished career, but clearly that changed when he started to object to Novartis' treatment of clinical data they provide to the FDA.

Novartis claimed, Courtney said, that Olagunju was fired for an "inability to get along with people." And of course, this may be a very plausible explanation.

I mean, hypothetically, if you have a bunch of crooks, and you tell the crooks you don't want to do the crooked stuff, then the crooks are going to say that you "don't get along with them." Which is, of course, entirely true. Not that we know if anyone at Novartis is a crook. That's up to the courts, and the FDA, to decide.

Courtney thought it was "very likely that the delay of FDA approval of Novartis' cancer drug Tasigna was due to the meeting Olagunju had with three FDA official on June 28."

Courtney also stated that Novartis had tried to silence Olagunju with a separation package when they terminated his employment. Of course, to get that package, Olagunju would have to sign a legal release that he wouldn't sue them, would never speak badly about Novartis, and so on.

Olagunju was not willing to sign the release, unless the company agreed to undertake an audit of the questionable data submitted to the FDA. Novartis refused to do so and Novartis also rebuffed Olaganju's efforts to work with them after his termination, to review the data.

It is interesting to observe this case. Irrespective of whom is proven right, Novartis now has a mess on their hands, with a delayed drug approval which could cost the company tens of millions of dollars.

Courtney summed it up, saying, "it seems like all these companies have read the same book about how to fire someone, what things to do to protect themselves, but in the end it doesn't really help them."

The WSJ Health Blog finally picks up on funny Lipitor numbers

So I was happy to note that the following day, the WSJ Health Blog picked up on where I left off; read more in WSJ's Inventory Bugaboos Dog and Aid Drug Makers from July 19.

I do note that the WSJ blog coverage of Pfizer's report on July 18, Pfizer Earnings Fall as Lipitor Crumbles, didn't have any of this analysis, and uncritically pretty much reported the company press release.

"Peter Rost and the fired Novartis Whistleblower"

The Whistleblower Law Blog is presented as a service of the Private Law Firm, LaBovick & LaBovick, P.A., Civil Justice Prosecutors. LaBovick & LaBovick is a Plaintiff's firm that represents whistleblowers in Florida and throughout the nation in qui tam (False Claims Act) litigation.

Thursday, July 19, 2007

The Novartis Whistleblower - Pharmalot Joins to Cover Story

This story is a pretty big deal, so I decided yesterday that it would only get better if some of the best journalists got involved from the beginning. So I've been working with Ed Silverman from Pharmalot on this.

He does his thing, I do mine, but you should read both stories.

In the drug industry we call that "co-marketing;" promoting the same drug (story) using two different brand (blog) names. That's how the drug industry makes 1+1=3.

Ed told me that is kind of unusual in the media industry. So we're first. Sorry, Novartis, we're trying it out on you guys.

I should probably make the disclosure that I've mentioned Novartis as one of the few drug company stocks to buy, since they have a better pipeline than most, and that many very good people, whom I know personally, work there, not that this has ever impacted what I wrote.

I also note that Novartis has clearly been helped by the stories I've written about AstraZeneca, the "bucket of money" affair and the termination of sales director Mike Zubillaga.

But a story is a story, and I think Novartis may have screwed up royally this time around. I'm not saying who's right or wrong, the courts will decide that . . . but they still appear to have really messed up, no matter who's right.

Should Drug Reps Know Every Detail of What a Physician Prescribes?

Today we have a guest columnist writing for Question Authority - PharmaSpy:

Today we have a guest columnist writing for Question Authority - PharmaSpy:Should Drug Reps Know Every Detail of What a Physician Prescribes?

Right now they can, down to a single prescription on a weekly basis. They know what percent market share any doctor writes for any drug. They also know how much of the competition that doctor is using.

But they’re not supposed to talk about it, especially with the doctor. It’s ‘proprietary company information’. Drug reps know more about what physicians write than the doctor himself.

Pharmaceutical companies buy pharmacy information from IMS (http://www.imshealth.com/)and other ‘data mining’ outfits as a ‘solution’ to ‘sales force effectiveness’. Here’s how they describe this service:

“One of the most critical success factors for any drug company is the productivity of its sales force. IMS supports sales executives, managers and reps with a range of offerings that empower them to make better, faster, smarter decisions in areas such as: segmentation, and call planning, sales force sizing and deployment, compensation and territory management.”

The word ‘segmentation’ is important here. Big writers are separated from losers. The top guys get all the perks of a drug rep’s attention: speaking engagements, honorarium, research grants, dinner lectures, samples, lunches, CME programs, cupcakes etc. The benefits are piled high to influence their writing habits under the guise of ‘patient health first’.

The good news is that AMA physicians have an ‘opt-out’ program, sort of like a ‘do not call list’ for prescribing data. Simply log onto the AMA website and click on the Physician Data Restriction Program (PDRP) link (http://www.ama-assn.org/ama/pub/category/12054.html ) to go stealth on the drug industry.

"What Pfizer does not want you to know"

Go here to read about Chinese finger traps and a succinct summary of The Whistleblower . . .

Go here to read about Chinese finger traps and a succinct summary of The Whistleblower . . .

Wednesday, July 18, 2007

Pfizer profit down 48%, but lets put some lipstick on that pig!

Reading financial reports is fun. I'm not kidding.

Reading financial reports is fun. I'm not kidding.When you get into the nitty gritty detail you discover the stuff the company press release seldom mentions.

Take Pfizer Inc.'s most recent quarterly report, filed today.

Things are going downhill pretty fast, with patent losses happening even faster than expected. It may not be as bad as the 48% drop in quarterly profits indicated, but believe me, it is bad.

Let's for instance look at Pfizer's flagship, Lipitor.

In Pfizer's first quarterly report for 2007 the company proudly announced, ""We posted sales increases for Lipitor . . . (up 8 percent) . . . We have implemented comprehensive plans that we believe will strengthen Lipitor's marketposition . . . On March 5, 2007, Lipitor was approved by the FDA for five new indications . . . "

Pretty upbeat, huh?

Well that changed pretty rapidly.

In the most recent report, Pfizer says that, "In addition, Lipitor, our most prescribed product, did not meet our expectations for the quarter . . . 25% decline in the U.S. Our U.S. Lipitor performance in the second quarter was negatively impacted by two factors we had highlighted in the first quarter of 2007 as positively impacting the brand.

These two factors, changes in the U.S. wholesaler inventory levels and differences in reconciliation of internal and external data that are normally seen each quarter to varying degrees, (really? couldn't find either the word "U.S. wholesaler inventory" or "internal and external data" in that first report) accounted for approximately 50% of the revenue decline in the U.S. second-quarter 2007 results and are not expected to have a negative impact on U.S. performance over the second half of the year.

Other contributing factors to the second quarter's performance include the decreased level of prescriptions as well as increased rebates associated with our more flexible contracting activity."

OK, so lets take that again, what is Pfizer really saying?

Well apparently some of the earlier Lipitor sales appear to have been driven by good ol' fashioned channel stuffing, and now the chickens came home to roost, and the wholesalers got rid of some of that inventory. That's quite a bit of channel stuffing. Isn't that what BMS got caught doing and paid some big fines and had a court monitor appointed for doing?

As far as "reconciliation of internal and external data" that sounds to me like "oops, we didn't really record sales correctly and now we're fessing up." All of this accounted for a whopping 50% of the decrease in sales.

The other half?

A "decreased level of prescriptions" and "rebates" which Pfizer tries to put a positive spin on, calling it a "more flexible contracting activity."

Isn't that what Detroit is doing with all those cars they can't sell?

I'm just asking . . .

But I guess those "comprehensive plans that we believe will strengthen Lipitor's marketposition," from the first quarter really didn't work out . . .

And the fantastic FIVE NEW INDICATIONS . . . no one cared about them.

At least not prescribing docs.

But there is more.

Since Pfizer's drugs lose patents faster than a seven year old loses her teeth, Pfizer has invented a new measurement:

"Pharmaceutical adjusted revenues, which excludes the revenues of major products which have lost exclusivity in the U.S. since the beginning of 2006."

Pfizer hopes by using this measurement, and comparing this number from year to year, they'll show investors how well they do on products that don't lose their patents.

But only a drug company in mortal fear of future patent losses would introduce such a measurement.

And, just to be on the safe side, Pfizer Inc adds:

"This additional revenue measure is not, and should not be viewed as, a substitute for the U.S. GAAP comparison of Pharmaceutical revenue."

If you're a Pfizer investor, this ain’t really funny. But if you aren't, this is the greatest smoke and mirror show in town.

Tomorrow: The Novartis Whistleblower

Art and cars. Or maybe Car Art.

Then there's the red Ferrari. Knitted by an art student. The knitting was hanged on a frame, created by this knitting student. Price? Priceless.