Stock options used to be a wonderful thing. Like printing your own money. Didn't even have to be expensed, so didn't impact company profit. Like money from thin air. But that wasn't enough for many executives.

Stock options used to be a wonderful thing. Like printing your own money. Didn't even have to be expensed, so didn't impact company profit. Like money from thin air. But that wasn't enough for many executives.The idea behind those options were that they'd make executives work harder to increase share holder value. That, of course, led to accounting fraud; WorldCom, Enron, and other scandals.

But that wasn't enough. The WSJ has for a long time shown how many companies also fiddled with the initial value of the stock options. In order for the options not to be expensed and impact profit, they had to have zero value when they were given. The idea was that hard work would then increase the share price and the value of stock options.

But that's too hard for most executives. I mean, they'd have to work.

So they soon realized that no one was looking, not share holders, not SEC and not auditors.

SO what they did was simple. They looked back at the year, checked when their stock was at the lowest point, and then simply backdated the options they gave to themselves, and of course, then the stock options suddenly were worth a lot right away, since stock value had usually increased.

But doing that changed the whole game. That meant the options should have been an expense to the company. But no one knew. Not until some researchers started digging and found this amazing correlation to dips in stock price and allocation of stock options. Like those execs had a crystal ball when they allocated options.

Well, they didn't. If it is too good to be true, it aint true.

The SEC, which doesn't do much on their own, of course had to take action when the whole thing was on the front page on the WSJ. That's how the SEC usually comes up with something to do. Read the WSJ.

SO, yesterday federal authorities issued civil and ciriminal securities fraud charges against one CEO, one CFO and one HR executive.

70 OTHER corporations are also under investigation, but a recent study indicates that as many as 2,000 companies may have abused the system. And of course the SEC will never have the resources to investigate them all.

A little cheating can go a long way. Why rob a bank when you can simply print your own money?

One executive with funny stock options is the CEO of UnitedHealth Group. His options are worth over a billion.

And so, the era of the Robber Barons goes on.

And the only thing that stands between them and the gold they can steel is the free press, such as the Wall Street Journal.

What an irony.

Read more here in the WSJ. Even the New York Times has picked up on WSJ's story, here. And here you can read about latest development.

6 comments:

http://www.youtube.com/watch?v=XCUr-mILbIw&search=who%20are%20you

Unbelievable.

Every day I come to a harder conclusion that we have the most corrupt and easily bought off congress in history. I remember reading some time ago about how the NEW congress that had promised to bring "Values" back to America started undoing all the rules and regs that were required for companies and how the SEC was basically a front that didn't really do anything unless you didn't pay your "vig" to them.

AND that new congress was the so called Contract On America ReThugs. Of course they are masters at deception and diversion.

LOOK!!! Someone is burning the flag!! EVERYONE GET UPSET AND LOOK AT IT and pay no attention to the man behind the curtain.

OH MY GOD TWO MEN WANT TO GET MARRIED AND LIVE TOGETHER!!! This is more important than any of this paperwork that you moro...um voters need to worry your empty little heads about, this is just banking stuff and not imnportant...LOOK OVER THERE!! SOME ONE WANTS TO TAKE YOUR BIBLE AWAY FROM YOU!!! OHMYGOD!!!

And what is more amazing is how many people fall for it.

As he said, "There's a sucker born every minute".

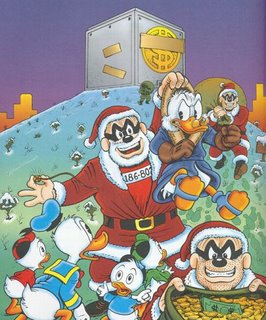

OH and by the way, I like your use of Uncle Scrooge. I use one of his images as my avatar on other sites.

Backdating options is just simple, gross, out-and-out fraud. It's identical to swapping the price tags on two items of merchandise in the store and trying to claim the benefit of the lower price at the register.

Fortunately, if the options were fraudulently back dated then there should have been income realized by the recipients of those options as of the grant date. Think any of them paid taxes on that income? Nah. So some IRS action should soon be added to the mix. The Treasury Department has always been somewhat more pro-active in enforcement than the SEC, don't you think?

Unfortunately, the expensing options under 123(R) won't solve the problem of piggish management - the problem goes far beyond stock options. Executives and their syphocants try to justify the absurd heights of executive compensation we are now seeing are by claiming their pay is "what the market will bear." The supply of truly honest and talented managers may be sharply limited (and those with such talent should be well rewarded for creating shareholder value). However, the simple truth is that many of this country's CEOs are rather lackluster (though it's better to have a lackluster CEO than a fraudster for a CEO). If executive comp levels are market driven then executive performance should be as well.

A good start would be for insitutional investors to insist upon "majority vote" provisions for the election of corporate directors. In fact, the stock exchanges should require it for companies to be listed. That way slacker board members couldn't coast to re-election each year. The stock exchanges should also require that, in addition to their current "independence" requirements, only directors who are nominated by shareholders that are not executive officers, directors or greater than 5% owners of the listed company may serve on the listed company's Compensation Committee. Those two steps should go a long way toward toning down the "old boy" compensation network that created the problem in the first place.

There was also an article about Back-Dating in the magazine Fortune (which I read from time to time, as I can't really stand WSJ for some odd reason). I talked to my mother regarding this topic, and she was surprised that this would even work. She offered a simple solution, one which has been used in the market of Taiwan as well as Japan (if I'm not mistaken).

Stop handing out stock options according to value of share, but the amount in shares. For instances, instead of handing out "1 million dollar worth of share", give them "100,000 shares". This way, there would be zero advantage of back-dating, hance eliminating the practice.

Easy eh?

-Reaniel

Sorry, that's not how it works. People get certain number of stock option at a certain strik price, which is supposed to be the same price as the value of the stock the day the option is granted. Hence, it has zero value until stock goes higher than the strike price.

Post a Comment